The Buzz on Google For Nonprofits

Wiki Article

Non Profit Organization Examples - The Facts

Table of ContentsThe Best Guide To Non Profit Organizations Near MeSome Known Questions About Npo Registration.501c3 Fundamentals ExplainedHow Nonprofits Near Me can Save You Time, Stress, and Money.Fascination About Non ProfitSome Known Details About Irs Nonprofit Search 501c3 Can Be Fun For AnyoneThe Ultimate Guide To Not For Profit

Online providing has grown throughout the years, and also it keeps expanding. Unlike several other forms of contributing (via a telephone call, mail, or at a fundraiser event), contribution web pages are extremely shareable. This makes them suitable for boosting your reach, and also consequently the variety of contributions. Moreover, donation pages enable you to accumulate and also track data that can inform your fundraising technique (e.donation size, when the donation was made, that donated, just how much, how they involved your internet site, and so on) Finally, donation pages make it convenient as well as straightforward for your benefactors to offer! 8. 3 Produce an advertising and marketing and also material plan It can be appealing to allow your advertising and marketing develop naturally, yet doing so presents more issues than advantages.

You could likewise consider running an email campaign with regular newsletters that let your viewers understand regarding the fantastic work you're doing. Be sure to gather email addresses and also other appropriate information in an appropriate way from the start. 8. 5 Look after your individuals If you haven't dealt with working with and onboarding yet, no fears; currently is the time - npo registration.

Getting The Google For Nonprofits To Work

Below's just how a nonprofit secondhand Donorbox to run their project and also get donations with a basic yet well-branded web page, maximized for desktop and mobile - nonprofits near me. Choosing a funding model is crucial when beginning a not-for-profit. It relies on the nature of the not-for-profit. Below are the various types of financing you could intend to take into consideration.To get more information, have a look at our write-up that talks more in-depth concerning the primary not-for-profit funding sources. 9. 7 Crowdfunding Crowdfunding has turned into one of the vital means to fundraise in 2021. As a result, not-for-profit crowdfunding is grabbing the eyeballs nowadays. It can be utilized for certain programs within the organization or a general contribution to the cause.

During this action, you may desire to believe about turning points that will suggest an opportunity to scale your nonprofit. Once you have actually run for a bit, it's important to take some time to believe about concrete growth objectives.

Get This Report about 501c3

Resources on Starting a Nonprofit in numerous states in the United States: Starting a Not-for-profit Frequently Asked Questions 1. How a lot does it set you back to start a not-for-profit organization?How much time does it take to establish a nonprofit? Depending on the state that you remain in, having Articles of Consolidation approved by the state federal government may occupy to a few weeks. When that's done, you'll have to request acknowledgment of its 501(c)( 3) condition by the Irs.

Although with the 1023-EZ kind, the processing time is usually 2-3 weeks. 4. Can you be an LLC as well as a nonprofit? LLC can exist as a nonprofit limited responsibility business, nonetheless, it should be completely possessed by a single tax-exempt not-for-profit company. Thee LLC must additionally meet the needs as per the internal revenue service mandate for Minimal Responsibility Firms as Exempt Organization Update.

More About Non Profit Org

What is the distinction in between a foundation and also a nonprofit? Foundations are usually funded by a family members or a business entity, however nonprofits are moneyed with their revenues and fundraising. Structures typically take the money they began out with, invest it, and also then disperse the money made from those financial investments.Whereas, the additional money a nonprofit makes are made use of as operating costs to fund the organization's objective. Is it tough to start a not-for-profit organization?

There are a number of actions to begin a not-for-profit, the barriers to entry are relatively few. Do nonprofits pay taxes? If your nonprofit earns any income from unconnected tasks, it will certainly owe revenue tax obligations on that quantity.

site web

Some Ideas on Irs Nonprofit Search You Should Know

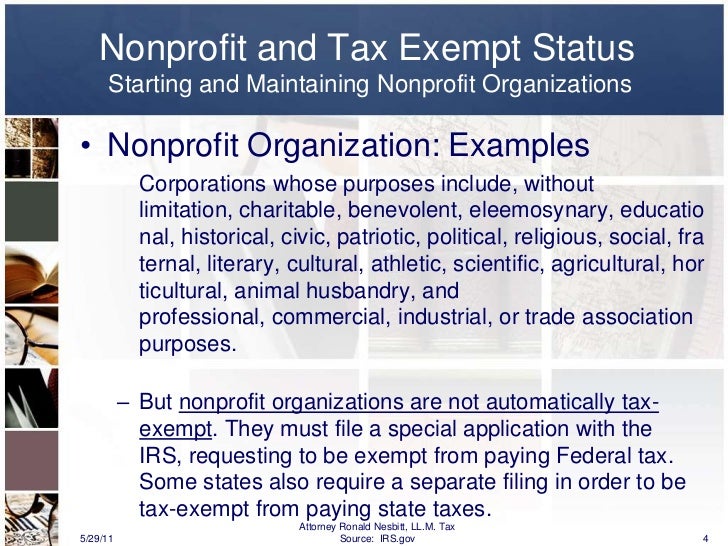

The function of a nonprofit company has constantly been to develop social change as well as blaze a trail to a much better globe. You're a pioneer of social modification you can do this! At Donorbox, we prioritize solutions that assist our nonprofits raise their contributions. We know that financing is key when starting a not-for-profit.Twenty-eight different kinds of not-for-profit companies are recognized by the tax law. However by much one of the most typical sort of nonprofits are Area 501(c)( 3) companies; (Area for profit business 501(c)( 3) is the component of the tax obligation code that licenses such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, instructional, or clinical. Area 501(c)( 3) company have one big advantage over all other nonprofits: contributions made to them are tax deductible by the donor.

This category is important since personal foundations go through strict operating guidelines and guidelines that do not put on public charities. For example, deductibility of contributions to a private foundation is more minimal than for a public charity, and also exclusive structures are subject to excise tax obligations that are not enforced on public charities.

The 2-Minute Rule for Non Profit Org

The lower line is that exclusive structures obtain a lot even worse tax therapy than public charities. The main distinction in between private foundations as well as public charities is where they get their monetary support. An exclusive structure is commonly regulated by a specific, family, or corporation, and also obtains most of its income discover here from a few contributors as well as investments-- an example is the Bill and also Melinda Gates Structure.This is why the tax obligation legislation is so tough on them. Many foundations just provide money to various other nonprofits. Nonetheless, somecalled "running structures"operate their very own programs. As a practical issue, you need a minimum of $1 million to begin an exclusive structure; otherwise, it's unworthy the problem and also cost. It's not unexpected, then, that an exclusive foundation has been referred to as a big body of money surrounded by people that want several of it.

Fascination About 501c3 Organization

If the internal revenue service categorizes the not-for-profit as a public charity, it keeps this condition for its very first 5 years, regardless of the public assistance it in fact receives during this time around. Starting with the nonprofit's sixth tax year, it needs to show that it fulfills the general public support examination, which is based on the assistance it obtains throughout the present year and also previous four years.If a nonprofit passes the test, the IRS will certainly proceed to check its public charity condition after the very first 5 years by requiring that a finished Set up A be submitted annually. Learn even more concerning your not-for-profit's tax status with Nolo's book, Every Nonprofit's Tax Overview.

Report this wiki page